Greater Wichita Partnership > Data & Resources > Opportunity Zones

Invest In Opportunity Zones

Opportunity Zones in the Greater Wichita region provide businesses additional options for expansion and growth. As the largest city in Kansas with a central global location and world-class talent pipeline, opportunity zones provide additional incentives to grow businesses here.

Established in the Tax Cuts and Jobs Act of 2017, Opportunity Zones provide tax incentives for investment in designated census tracts supporting new investments and redevelopments in the community.

In April of 2018, 74 census tracts across the state of Kansas were nominated to be designated Opportunity Zones by the U.S. Department of Treasury, nine of which are located in Wichita.

How Opportunity Zones Work

- The Opportunity Zone program offers tax incentives for investors including the deferral and reduction of capital gains taxes when the gain is invested in a Qualified Opportunity Fund (QOF) and maintained for a period of at least five years.

- Investors can defer tax on any prior gains invested in a QOF until the earlier of the date on which the investment is sold or exchanged by December 31, 2026.

- If the QOF investment is held for longer than five years, there is a 10% exclusion of the deferred gain with that increasing to 15% after seven years.

- If the investor holds the QOF investment for at least 10 years, the investor is eligible for permanent exclusion from taxable income of capital gains accrued on the QOF investment.

Opportunity Zones in Wichita

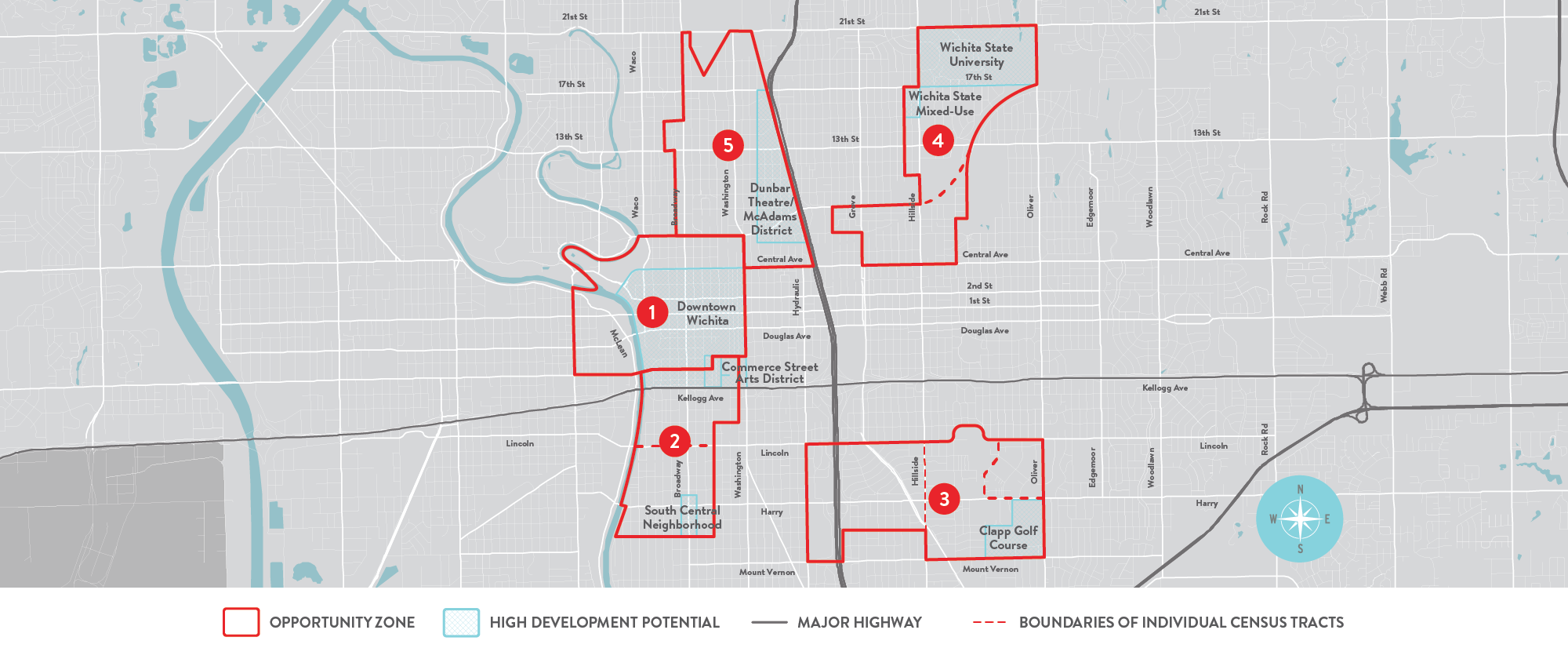

With nine land tracts located in Wichita designated as Opportunity Zones, contiguous tracts were combined to form five larger zones:

- Downtown Wichita

- South Wichita

- South East Wichita

- North East Wichita

- North Wichita